This means that no tax is. 2 can u please send me the EPF circular of EPFO Of 2012 where they added dearness allowance also as component of basic wages.

All About Allowances Income Tax Exemption Ca Rajput Jain

Any allowance or perks granted to the chairman or any member of the UPSC.

. This entire contribution goes to the EPF account of the employee. Exemption on Housing Loan. It falls under the EEE exempt exempt exempt category where the accrued interest and the.

This continuity and a generous interest rate make EPF an excellent retirement tool. Exempt-Exempt-Exempt category of savings products. What are the contribution percentages towards an EPF.

Members can avail a non-refundable withdrawal of up to 75 of the amount available in their EPF account or 3 months of their basic wages and dearness allowance whichever is lower. But this rate is revised every year. Types of Exempt Income.

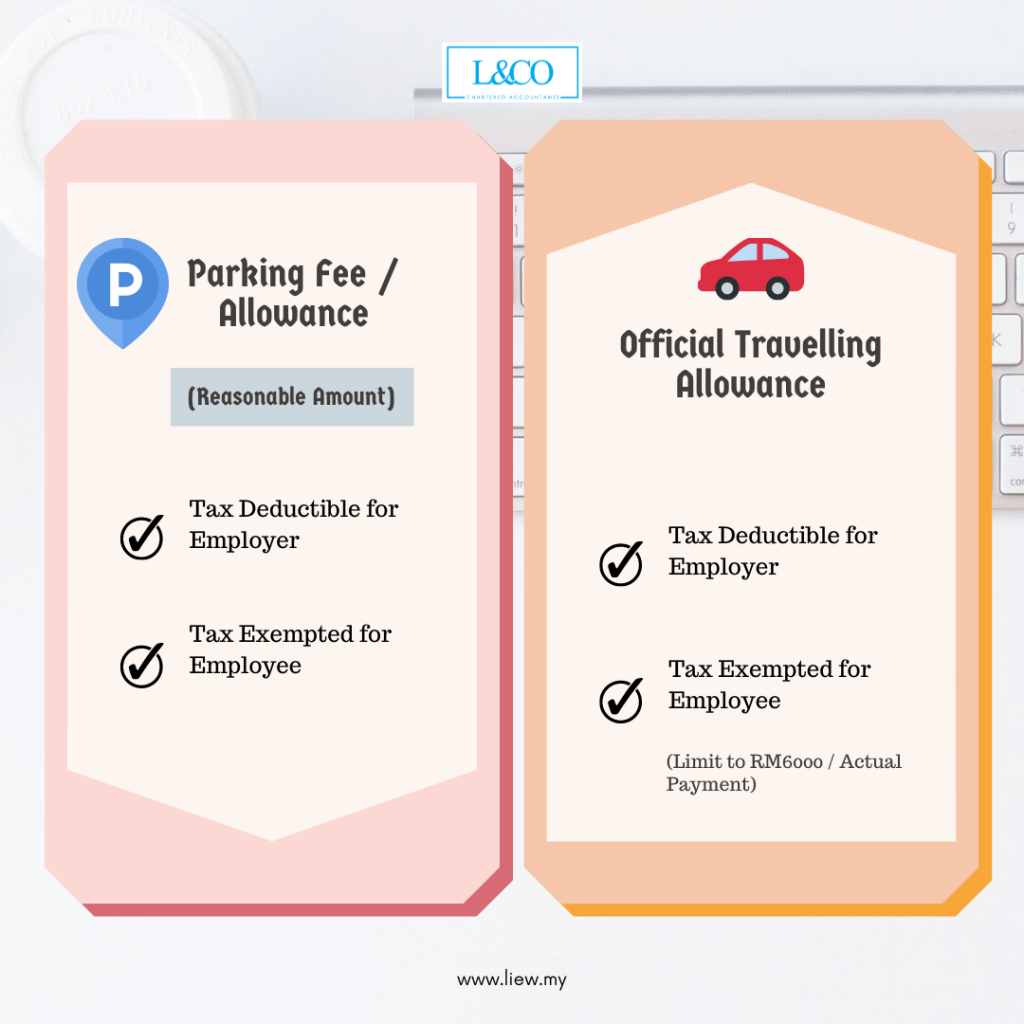

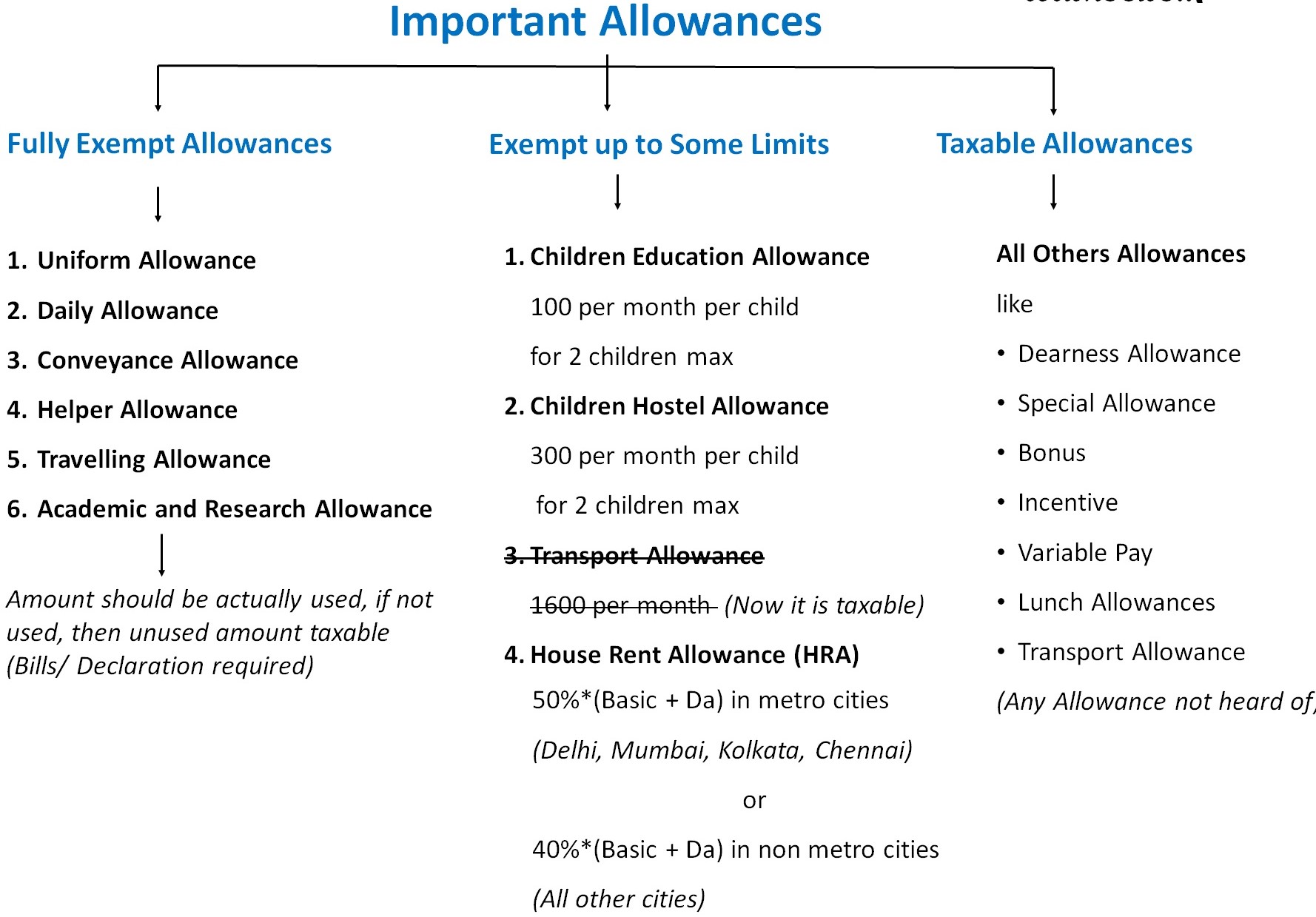

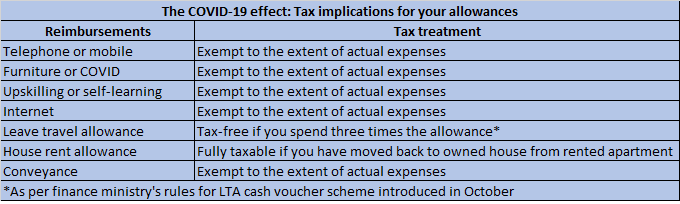

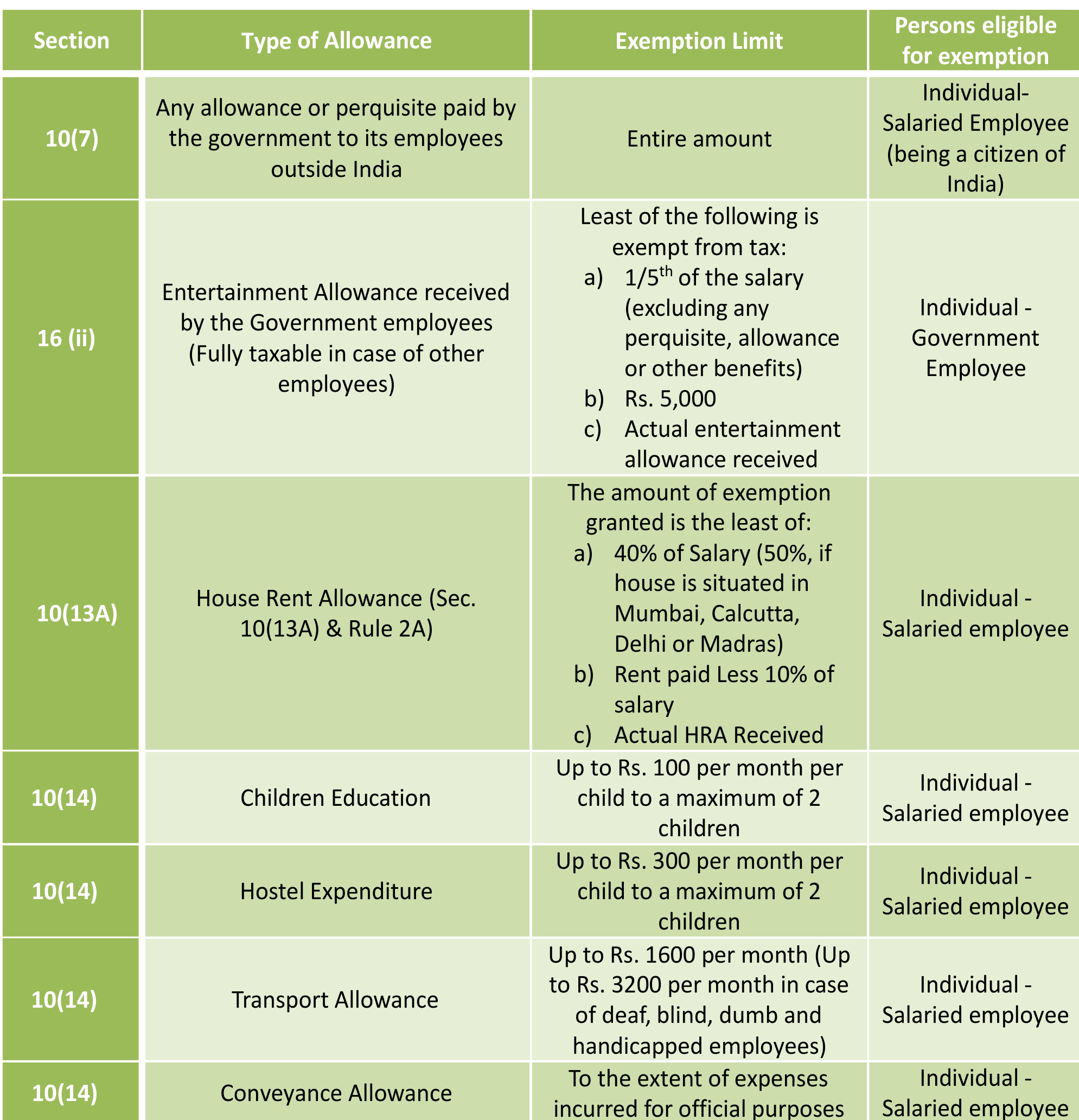

Conveyance Allowance allowed for Handicapped people. Transport allowance or conveyance allowance a benefit paid to employees who must commute from their homes to the office is tax exempt below INR 19200 per year. HRA is mainly determined by your salary.

Section 1047 Any income that is exempt under. That is the money you invest in EPF the interest you earn. Lets say your salary Basic Salary Dearness Allowance Rs 50000 per month.

How to Claim Relief Under Section 891 On Salary Arrears. The extent of the employers obligation to. As per latest EPF rules the employee contribution is 12 of Basic Pay Dearness Allowance.

The conveyance allowance for handicapped people is INR 3200 per month INR 38400 per annum. This fund falls under the EEE Exempt-Exempt-Exempt taxation regime. As per the PF act employees earning above 15000 per month are exempt from the pf deductions My query is if the gross salary is 18000.

Income defined as per Section 10 Section 54 of the Income Tax Act 1961. There are three scenarios upon which 100 of the EPF can be withdrawn. Taxation on EPF withdrawal.

Now following are the contributions made by you employee and the employer. Both the employee and the employer contribute 12 of the employees base salary and dearness allowance to the EPF. There should be no break in the 5 years.

Medical allowance paid to employees who need to take time for extended illness or to care for sick family members is tax exempt below INR 15000. Exemption based on the required amount or the lesser of the permitted amount. 1st E investments in EPF up to Rs 15 lac per year eligible for.

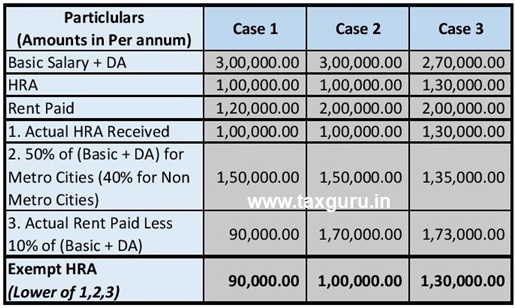

Not submitted rent documents to the employer. EPF is calculated on the salary where salary Basic DA Dearness Allowance In private organisations salary Basic. As per the income tax rules the tax-exempt part of the HRA House Rent Allowance is the minimum of the following amounts.

Following are the types of income that are exempt from tax-House Rent Allowance. Allowance on transportation childrens education subsidy on hostel fee. EPF is the main scheme under the Employees Provident Funds and Miscellaneous Provisions Act 1952.

An exempt portion of the HRA component is to be added under the heading allowances to the extent exempt us 10 ensure that it is included in salary income us 17 1 172 17 3. The scheme is managed under the aegis of Employees Provident Fund Organisation EPFO. Furthermore EPFO is set to settle these withdrawal claims within 3 days and has also created an auto-claim settlement process for members whose KYC is complete in.

The standard deduction of INR 50000 as announced in the Finance Act 2018 and revised at the Interim Budget 2019 is not available to. The contributions made in EPF are tax exempt. Tax deducted at source TDS is deducted on the premature withdrawal only if the amount exceeds Rs.

50 of basic salary if he resides in Delhi Chennai Kolkata or Mumbai. 1she is eligible to get CPF contribution by including her dearness allowance. Provident Fund or EPF comes under the E-E-E or Exempt-Exempt-Exempt category of savings products.

The money withdrawn from EPF accounts can be exempt from tax under certain conditions. Dr Surana further said that allowance such as Daily allowance Uniform allowance Research allowance are exempt under section 1014 of income tax Act. On top of it EPF taxation comes under the exempt-exempt-exempt EEE category which means the maturity amount will not attract any capital gains.

In case if you do not have the required rent documents or have forgotten to submit the same with your employer then you need to manually calculate the HRA amount which is tax-exempt. Exempt allowance is further subdivided as follows. Actual HRA component of salary.

Section 1046 Any income that comes under the category of specified income with regards to specific authoritative bodies. Under section 45 of the Employees Provident Fund Act 1991 EPF Act employers are statutorily required to contribute to the Employees Provident Fund commonly known as the EPF a social security fund established under the EPF Act to provide retirement benefits to employees working in the private sector. Leave and Travel Allowance.

Please note that if you file ITR online through Clear the software auto-populates the Form 16 component. Contribution period must be over 5 years. Under the Employees Provident Funds and Miscellaneous Act 1952 the EPF runs as the primary scheme for pension benefits.

40 if his residence is in any other city. Exemption based on a specific method of computation. The EPF contribution is either 1800 INR per month or 12 of the salary.

The investment in the EPF Scheme gets a tax deduction up to a maximum of Rs 15 lakh per year under opt-out Section 80C of the Income Tax Act 1961. Exemption based on the lesser of the allowance amount or the amount spent for the allowance. The employer deducts 12 of the employees salary basic dearness allowance directly every month for a contribution towards EPF.

As of now the EPF interest rate is 850 FY 2019-20. Exemption from Tax Your EPF falls under the EEE Exempt Exempt Exempt category. Information on How to Link Aadhaar with EPF Account.

Actual rent paid less 10 of. As an employee working in a corporate set-up there are several things one would like to know about the Employees Provident Fund EPF. Select 1013 Allowance to meet expenditure incurred on house rent from the dropdown menu.

Which Allowance Is Exempt From Salary Quora

All About Allowances Income Tax Exemption Ca Rajput Jain

Employee Benefits That Are Tax Deductible Employers Tax Exempted Employees L Co

All About Allowances Income Tax Exemption Ca Rajput Jain

Tax Benefits On Epf Employer Employee Contribution Impact Of Withdrawal Before 5 Years Saving For Retirement Facts Money Today

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

Work From Home Here Is How Reimbursements And Allowances Will Be Taxed

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

How To Add Conveyance Allowance As A Deduction In Itr 1 While E Filing Quora

How To Add Conveyance Allowance As A Deduction In Itr 1 While E Filing Quora

Leaving India To Become An Nri Here S What You Do With Your Pf Account

Download Gratuity Calculator India Excel Template Msofficegeek Payroll Template Excel Templates Templates

Post Budget Tax Math Should You Shift From Epf To Nps Now Mint

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

All About Allowances Income Tax Exemption Ca Rajput Jain

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

Allowances And Deductions Available To A Salaried Person A Complete Overview

Know Salary Segments That Can Reduce Employees Tax Liabilities